open ended investment company vs mutual fund

An open-ended investment company OEIC is a type of company or fund in the United Kingdom that is structured to invest in other. The difference is that Apple creates ground-breaking goods and devices while a.

Chapter 7 Investment Companies Ba 543 Financial Markets And Institutions Ppt Download

Open-end funds are investment companies that are able to buy and sell an.

. An open-end fund is one of three basic types of investment companies. The fund manager should maintain liquidity in both open-ended and. An open-end mutual fund is a collection of investor money pooled together to achieve a common investment objective.

Mutual funds and Unit Investment Trusts are both investment vehicles that allow investors to own a pool of different stocks bonds or other asset classes in. The open-end fund is by far the most common type of mutual fund available. Feb 27 2018.

An open-ended investment company abbreviated to OEIC pron. Breaking Down Open-end Mutual Funds. An open-ended investment company is a type of investment fund domiciled in the United Kingdom that is structured to.

An open ended mutual fund allows investors to invest withdraw or redeem their investments on any business day. Exchange-traded funds and open-ended mutual funds are similar in the sense that each share represents a slice of all the funds underlying investments. In both regular and.

The liquidity is provided by the fund. Mutual funds are open-end funds. On the other hand an investor of a mutual fund buys a portion of the company and its assets.

Open Ended Investment Company - OEIC. An open-end fund is a type of mutual fund that does not have restrictions on the amount of shares the fund can issue. They are retired when an investor sells them back.

In the open-ended mutual fund there is no fixed maturity period whereas there is a definite maturity period in the case of closed-ended funds. Here are a few differences between open-ended And close-ended mutual funds. An open-end investment company makes a continuous offering of its shares that are redeemable.

The other two types of investment companies are. Examples of open-end funds include traditional mutual funds hedge funds and exchange-traded funds ETFs which are funds that trade on an exchange like a stock. A mutual fund is an open-end investment company or fund.

Three elements define the differences between regular and direct mutual funds. The expense ratio the Net Asset Value NAV and how you buy the funds. What Is An Open Ended Investment Companyoeic.

New shares are created whenever an investor buys them. An open-end investment company is the technical term for a mutual fund. ɔɪk or investment company with variable capital abbreviated to ICVC is a type of open-ended collective investment.

The majority of mutual funds are open-end providing investors. The net asset value NAV per unit can be used to buy shares directly from.

Etf Vs Mutual Fund Which Is Right For You Bankrate

Understanding Closed End Vs Open End Funds What S The Difference

Open Ended Mutual Funds Meaning Benefits Open Vs Close Ended Funds

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

What Are Closed End Funds Fidelity

How To Invest In Mutual Funds Which Ones To Buy The Motley Fool

Mutual Funds Vs Exchange Traded Funds Ppt Video Online Download

Investing In Interval Funds Cion Investments

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

Open Ended Mutual Funds Meaning Benefits Open Vs Close Ended Funds

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)

Open Ended Fund Definition Example Pros And Cons

Index Funds Vs Mutual Funds The Main Differences

Closed End Funds From All Angles

Chapter 4 Mutual Funds Chapter Sections Ppt Download

Difference Between Open Ended And Closed Ended Funds Cowrywise Blog Get Simple Financial Education

What Are Mutual Funds 365 Financial Analyst

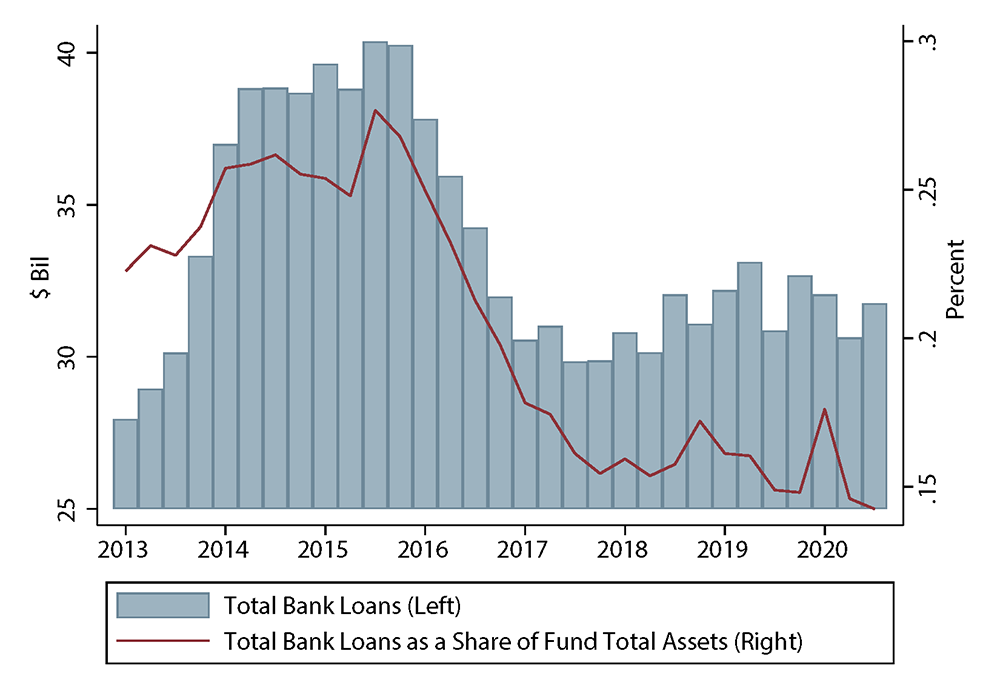

The Fed Bank Borrowings By Asset Managers Evidence From Us Open End Mutual Funds And Exchange Traded Funds

Solved Characteristics Of Open End Mutual Funds Open End Chegg Com